Evaluating Biofuel Investment: Are Current Policies and Resources Sufficient for Long-Term Success?

Nowadays, we come across various bio-energy-based fuels like Ethanol, Compressed Bio Gas (CBG), Pellet, Yellow Hydrogen, etc. while following progress on subjects like decarbonization, net zero, fuel switching or substitution, climate change, etc.

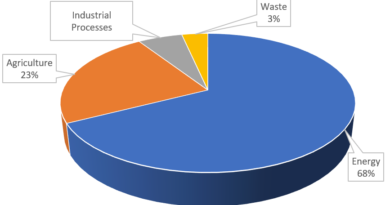

This is due to their importance in aspects like the reduction of India’s dependence on imported fuels, GHGs, air pollution, poverty in the agrarian communities, waste, etc. on one side and the other side helping India achieve its climate commitments under the Paris Agreement.

Worth mentioning here about the Government of India’s blending targets since this gives confidence to any investor.

- Bio-Ethanol : – 20% by the end of the Ethanol Supply Year (ESY) 2025-26. This is a five-year advance from the previous target of 2030. It is also called E20 Petrol.

- CBG: CBG Blending Obligation (CBO) will be voluntary till FY 2024-2025 and mandatory blending obligation would start from FY 2025-26. CBO shall be kept as 1%, 3% and 4% of total CNG/PNG consumption for FY 2025-26, 2026-27 and 2027-28 respectively. From 2028-29 onwards CBO will be 5%.

- Biomass Pellet: The Government of India’s target for biomass pellets in thermal power plants is to co-fire 5% biomass in the fiscal year (FY) 2024–2025 and 7% in FY 2025–2026.

Besides the target of the government , the central government as well as various state governments have come up with suitable policies for the sector’s growth. All this information is very encouraging but not sufficient to decide about an investment on these projects.

The analysis of this fact lies with the importance of understanding the requirement of various feedstock, it’s availability , possible price volatility and supply chain issues. Unlike Solar Energy where no such feedstock or input fuel is required, Bio-energy projects need the bio resources as input feedstock for its operation. Let’s understand about the requirement of biomass based feedstock materials as below :-

- Bio-Ethanol : crop like sugar cane , grains like rice, maize (corn ), Agri residues like straw ,rice husk

- CBG : agri residue like straw

- Biomass Pellet : rice huck, bagasse, wood waste,etc.

- Yellow Hydrogen : agricultural waste or forestry residue

The general understanding is that there is availability of large arable land and rising production of crops and grains will lead to surplus to support the transition to biofuels. But, the problem is that there are competing usages that is same resource is required for various applications leading to less availability of the resources that is supply crunch and price increase.

The assessment of feedstock resources along with understanding of the competing usages of the same is a must prior to setting up any project. The long term agreement with the feedstock suppliers is another key requirement to freeze the price volatility and any quality and supply surprises. The learning can be drawn from the ethanol experiences. The requirement of maize has increased due to the non-availability of the rice leading to increase of maize price and availability. The maize had matured market for poultry and animal feed besides other requirements. This has resulted into the suffering of all the players who are dependent on maize and turned India into a net importer for the first time in decades , And, the grain based ethanol manufacturers had to supply ethanol to oil marketing companies at a loss of Rs. 8-9 per Liter.